WhiteHat Jr was valued at $30 Million in our Series A funding round in Sep’ 2019.

Nine Months later, we received term sheets for upto $450 Million valuation.

What made the company 15x more valuable in just 9 months?

Yes, our business expanded. The team got stronger. But there was a deeper change that happened.

Our vision grew.

StartUp valuations are strange at an early stage. A young startup’s value is almost all in the future versus the present.

How do you mathematically value a dream?

Here I share detailed personal learnings on valuation and ownership, including mistakes I made, which I hope are useful for folks planning to start their own companies. Also for those who’ve often puzzled why young 20-month old startups are valued higher than twenty-year-old companies!

First off, here is WhiteHat Jr’s valuation progression

| Funding Round | Date of Closure | Valuation¹ |

|---|---|---|

| Seed | Dec’ 2018 | $6 Million |

| Series A | Sep’ 2019 | $30 Million |

| Series B (Turned midway into Acquisition by BYJU’s) | July 2020 | $300 Million² |

1: Post-Money Valuation

2: Acquisition Cash Amount. In parallel, we received Series B Fundraising Term-Sheets: $250MM-$450MM.

My Learnings- The Only 2 Things That Matter For Valuation: 1. Your Future Vision and 2. Your Current Business

1. How “Big & Obvious” is Your Vision for Tomorrow?

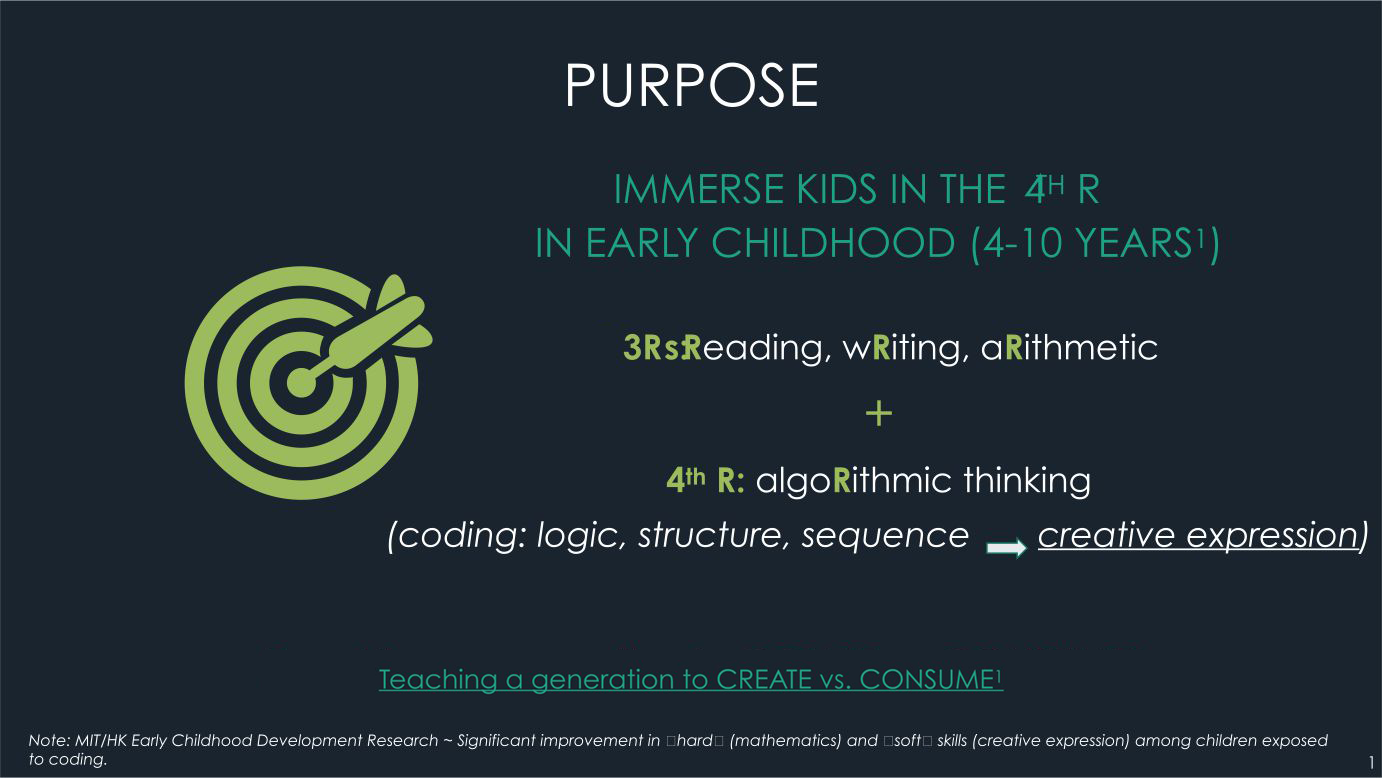

In 2018, I presented WhiteHat Jr’s vision as Live Coding for Kids to introduce kids to the most important skill of the future.

By 2020, I was confidently stating our real vision of enabling Every Kid in the World to be a Builder and a Creator versus a consumer.

The 2020 vision was Big and Obvious, encompassing multiple countries and categories–from Coding to Music to Arts–and most investors wanted to be a part of it. Valuation size was almost an afterthought. In contrast, the 2018 vision was small and specific.

Both had their roles.

You need to build credibility by successfully addressing a narrow problem first. But if I were to do it again, I’d confidently state the larger vision that led me to create the company from the start. I was so jaded by the early responses to the idea from friends and family– “no one will pay for creativity in India” etc. that I deliberately underplayed my vision to sound “practical” enough to secure funding.

I would’ve probably raised more funding at a higher valuation with a bigger vision in 2018.

Do you have a big vision to transform the world? Yes, it may start with a small, specific step, but don’t hesitate to paint your full vision. The larger your ambitions, the larger will be your company’s projected future value.

2. How Real is your Business Today?

I started all my funding decks with a business growth chart

Growth today is the best validation of your vision for tomorrow.

Your vision now has real value as users are ready to part an asset they deeply value–their money–for it. Now, your valuation will keep increasing in proportion to your business. Else it’s still a dream.

All the other elements–your team, Tech IP, competitive multiples–that feed into valuation calculations are inputs into the above. For example, a big vision typically attracts great people; great people come together to make great Intellectual Property(IP); great IP means you break all competitive benchmarks etc.

Startups are hard but the good news is you just need to focus on these two things-your visionary product and your business. And almost nothing else. Founder’s personal brand building, Investor coffee meetings, networking events, Celebratory Social Media posts, PR articles, industry conferences, all of it is useless for driving value.

You just need to build and sell.

And the rest just follows.

WhiteHat Jr’s 18 Months Seed-to-Acquisition Journey: Other Learnings on Valuation & Ownership

I wish I’d seen a chart like the below before, especially in the Seed Stage, when I didn’t know how to value my idea since it was little more than a powerpoint presentation. And how much ownership to dilute to raise capital.

| Funding Round | Funding Raised | Valuation¹ | Founder Ownership | Investor Ownership | ESOP-Employee Ownership |

|---|---|---|---|---|---|

| Seed- Dec’ 18 | $1.3 Million | $6 Million | 60% | 21% | 19% |

| Series A- Sep’19 | $10 Million | $30 Million | 39% | 47% | 14% |

| Acquisition: Cash Exit- July’20 | – | $300 Million | 39% | 47% | 14% |

2018-2020: WhiteHat Jr Ownership Chart

A few Quick Observations on the Above

- Seed Stage Valuations are pretty much pointless but Cash is useful: WhiteHat Jr’s destiny would be completely un-impacted by a lower or higher valuation than the $6 Million at Seed stage. But Cash is Oxygen for a startup. More cash gives you more chances to survive. And if I were to do it again, I would’ve tried to raise $5 Million in cash at $20 Million valuation, right at seed stage, by demonstrating a bigger vision for the company.

- Your Valuation/Ownership Chart Reflects Your Daily Values: I received constant feedback along my journey that I diluted too much equity to investors as an experienced founder (47% Investor Ownership at Series A itself!) or had allocated too much ESOP to employees (19%, 1.5-2x norm) for a solo-founder. But I knew at the onset that I was building for:

A. Speed: I closed both my funding rounds within 30 days each, allowing WhiteHat Jr to keep building super-fast. Versus a prolonged, long-drawn fundraise optimizing for ownership and valuations.

Speed, for us, was a strategy rather than an execution choice.

We were among the last to arrive in a crowded Ed Tech category, where all the major players had already raised tens of millions of dollars of funding. But thanks to speed, by the time competitors realized that coding for kids could be a major category, it was already gone.

B. Team-on-a-mission: I wanted all our top talent to be “owners not renters” in the mission and own the company with the same intensity as I. So I doubled the ESOP pool (19%) at Seed stage versus a typical cap-table(10-15%).

I’d attribute the entire WhiteHat Jr blitzscaling, where the whole team went over and above daily, to the above principles of speed and ownership. Your principles may be different but be conscious about them since they’ll shape your company’s actions daily.

Finally, does Investor FOMO (Fear-of-Missing-Out) drive valuations?

Yes, there’s greed and fear in fundraising, as is every part of human nature. In both my funding rounds, getting multiple offers drove up significant interest for WhiteHat Jr, sometimes more so than the fundamentals themselves.

“An Empty Pageant; A Stage Play; Flocks of Sheep; A Bone flung among a pack of Dogs; Ants, loaded and laboring; Mice, scared and scampering; Puppets jerking on their strings; This is life.

In the midst of it all, You must take your stand, good-temperedly and without disdain.” – Marcus Aurelius, Meditations.

Yet I walked away with very deep respect for the fundraising process. I was Head of Discovery India and ran P&Ls many times in my jobs before but never looked at a business in as much depth–CAC:LTV, cohort renewals and retention, fully-loaded margins etc–as I learnt to do from my investors. And each time, I felt their valuations accurately reflected the scope of my ambitions and the reality of our business.

All in all, I found everyone from investors to employees to customers, going over and above, to rally behind a vision for a new, better world. And a startup’s value will eventually shrink or expand in proportion to the smallness or bigness of this vision. So always keep it big!

I hope this was useful! What is your big & obvious vision for your startup? I’d love to hear your ideas in the comments below! Also, don’t forget to let me know what other question you have about succeeding in a startup? I will answer more questions in future posts!

And if you found this useful, you may also like this new YT Video (<5 Minutes) on the One Truth About Money.

Please subscribe to the channel here for 3x new videos/week on startup and success models.

77 Comments