I wasn’t satisfied with the WhiteHat Jr Seed Fundraising Pitch Deck. We were following conventional wisdom, starting with the market opportunity, TAM, SAM etc. But StartUps follow a Power Law.

10% of StartUps will deliver 80%+ of a fund’s returns.

Does your deck immediately demonstrate that you’ll be in the 10%?

A top Venture Capitalist(VC) accepts 1 among 150 pitches made to them¹.

Can you be The One?

Fortunately, I learnt how to write better pitch decks in subsequent funding rounds. Here I share my best learnings on how to write a successful startup pitch, which I hope is of some use to budding entrepreneurs to get their “1-in-150” idea funded!

First off though, who are the Top Indian VCs to pitch your deck to as an Early-Stage Entrepreneur?

Immediately after the positive results of the WhiteHat Jr zero-code prototype, I made a list of the Top 30 Indian VCs from secondary sources and reached out cold to each one.

Here are my Top Indian VC recommendations based on their response and subsequent process- please drop me a note in the comments with some info about your company if you want email contact details–will share with due permission. Note, three among the below rejected my pitch quickly, yet they followed these 5 attributes which I think are most critical for early-stage entrepreneurs:

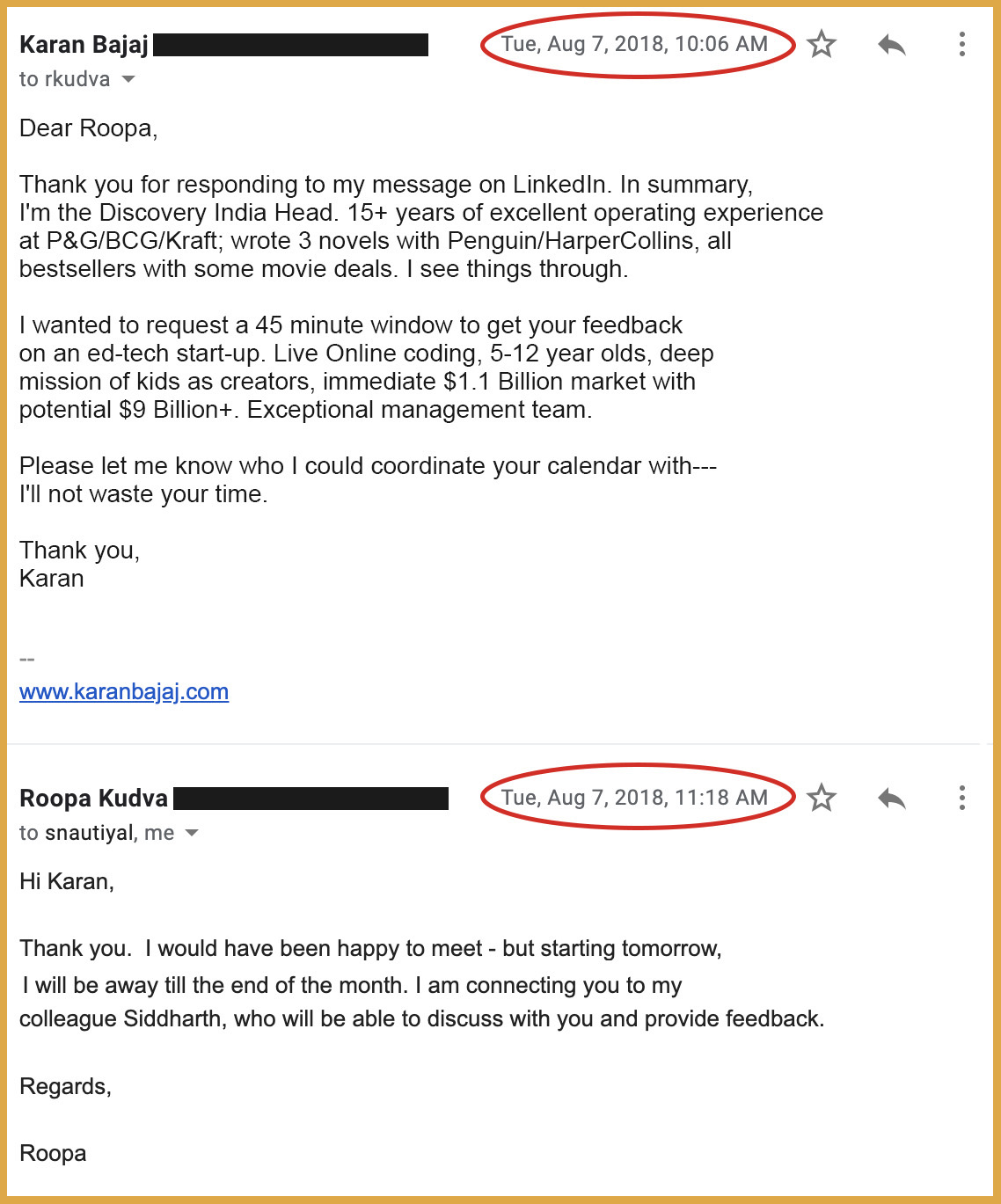

1. Incredibly Fast Response Time: I was building the team and product from my own savings after the prototype and I knew I would run out soon without external funding. Time is your enemy as an entrepreneur and fast response is perhaps the #1 desired VC trait.

Sample: Omidyar’s Head Roopa Kudva responded within hours to my outreach despite being out-of-office.

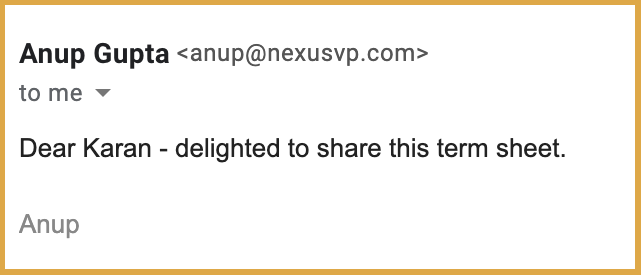

2. First Conviction: In all my funding rounds, I saw the moment you had the first investor term-sheet, suddenly everyone else followed. The best VC’s show independent conviction versus waiting for others to jump first.

Sample: Nexus’s Anup Gupta was the first to show conviction when others were still indecisive.

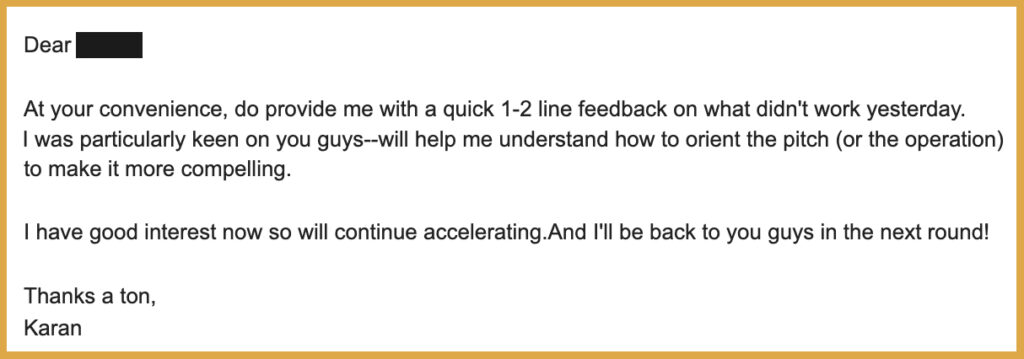

3. Closure Follow-Up: I was often left hanging after a pitch, not knowing whether we were still in the process or rejected–tough for an early-stage team who’s checking their Whatsapp 24×7 to get a response!

Sample: I had to send several emails and Whatsapps like these to a Top VC partner before self-rejecting!

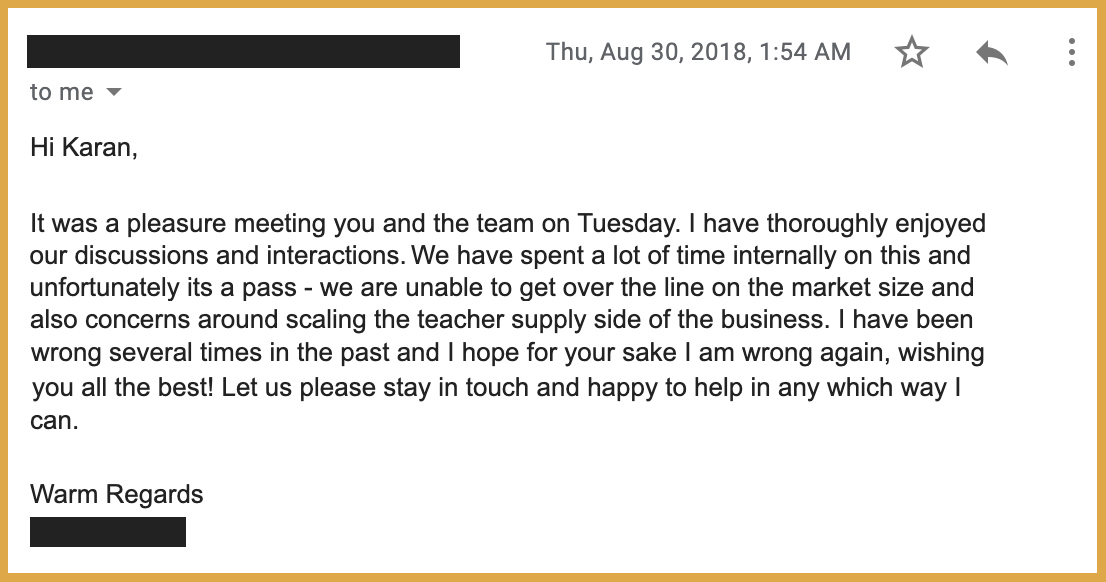

4. Entrepreneur Respect: I was made to wait 4 hours in the Bangalore office of a Top VC, after which she dismissed the presentation within 7 minutes. My pitch should’ve been better, for sure, but investor rejections too can be dignified and respectful!

Sample: A Top VC’s polite and dignified rejection–thanks Ravi Kaushik, WaterBridge Ventures

5. Empowered Team: Finally, Top VC’s have an empowered team. As every entrepreneur would tell you, you’ll spend months with a VC-team Associate who visits your office and gets excited about every detail of your model but the partner dismisses you within a minute. Why take so much of an entrepreneur’s time when the team is not empowered to influence decision makers?

Sample: Too many to share 🙂

Among the Top 30 India VCs I reached out to, the below exceeded my expectations on all 5 criteria above (even though Matrix, Blume and Sequoia rejected my first pitch)-and I recommend them highly for early-stage entrepreneurs.

1. Nexus Venture Partners Anup Gupta and Pratik Poddar

2. Matrix Partners India Rajat Agarwal, Vikram Vaidyanathan

3. Omidyar Networks India Siddharth Nautiyal, Sarvesh Kanodia, Namita Dalmia

4. Blume Ventures Sajith Pai

5. Sequoia India Abheek Anand, Rajan Anandan, Ravishankar GV

Please drop me a note in the comments if you want email contact details or reach out to them on LinkedIn with this blog’s reference.

Now, what is your Ideal Startup Pitch deck structure?

Your pitch deck should answer with 100% conviction the only 2 questions that truly matter for an investor:

1. How Strong is Your Business Today?

2. How Big and Obvious is Your Vision for Tomorrow?

That’s why I recommend only these 12 Slides for a Pitch Deck, structured into a Rule of 4, 3 sections of 4 slides each. Just do Section 1 right though and you’ll have a high probability of securing funding! Note, the exact same layout will also work for subsequent funding rounds (Series A, B etc.) as the questions don’t change-only the scale gets bigger.

Section 1: Company Vision & Results

- Company Results: Growth & Performance vs Plan

- Company Vision

- 3 Pronged Business Strategy

- Consumer Passion

Section 2: Market Opportunity

- Market Size

- Category Tailwinds: Why Now?

- Your Tech Disruption in Market

- Competitive Differentiation

Section 3: Funding Request

- Unit Economics

- 3 Year Growth Strategy

- Application of Funds

- Management Team

I’ve shared sample dummy slides for an ideal deck below. But please drop me a note in the comments if you’d like any of the following:

1. Dummy Deck-Hard Copy

2. Presentation Formatting-expert freelancer Contact– I used the freelancer to make slides look professional (despite being a BCG consultant myself :-))! UPDATE: Please contact Sridharan Gunasekaran intake@slidemarvels.com. He was incredibly fast and helpful in formatting all my decks.

3. Legal/Finance Freelance team who helped me build early financial models and set up legal entities- Contact Details. UPDATE: Please contact Jitesh Agarwal at Treelife jitesh@treelife.in, who along with his partner, Garima Mitra, set up all our early legal and financial structures which held from Seed to Acquisition.

4. UI/UX Team- who helped create the early version of the WHJ product. I highly recommend the outstanding team of Saurabh and Hemal from Zeux, true experts in user-centric design, gamification and communities with the speed of a startup. saurabh@zeuxinnovation.com hemal@zeuxinnovation.com https://zeuxinnovation.com/

For each of the above, please feel free to use my reference for a hopefully quicker response.

Your Ideal StartUp Pitch Deck for all Funding Rounds: Dummy Deck with Sample Slides

Slide 0 Your Personal Story: Always start the presentation with the extremely deep, personal reason you started the company (no slide needed). Example, I always shared the WHJ origin story openly– I wanted my own kids to be creators early, for life, because I discovered the depth creation brought to my life very late–and conventional school systems would never be able to provide that.

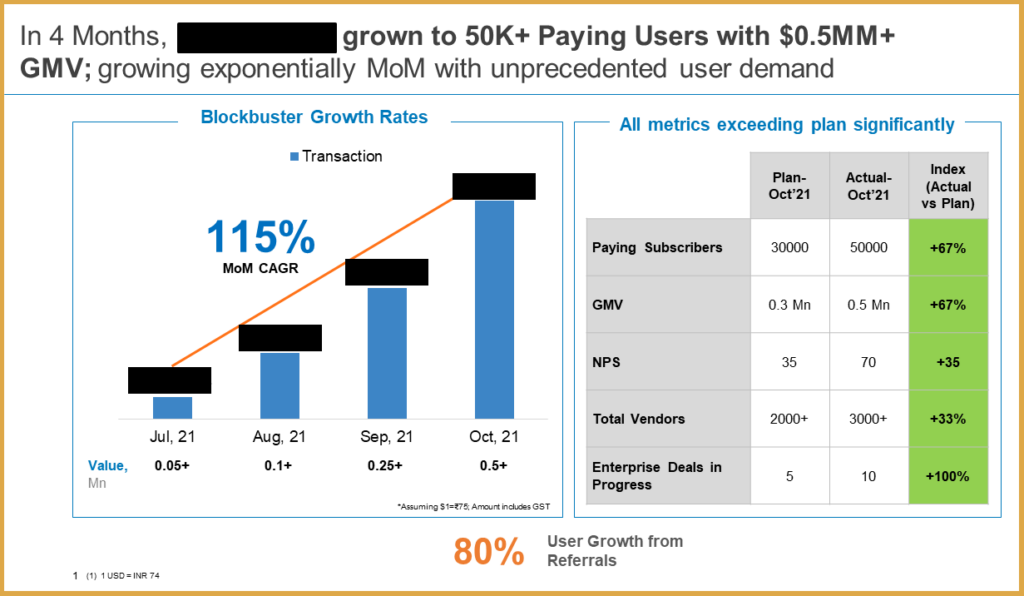

- Slide 1: Results- Growth & Performance vs Plan, even if you have 30 customers! Growth today is the best indicator of your potential for tomorrow so always start with this.

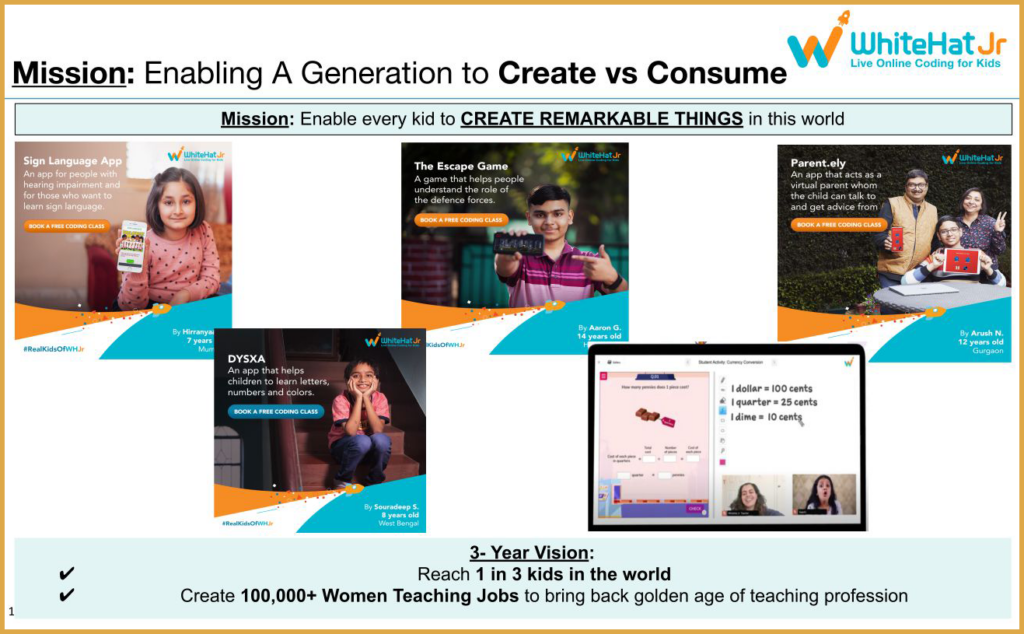

- Slide 2: Vision– Your Big & Obvious Vision- how will it impact millions of users/meet a deep human need?

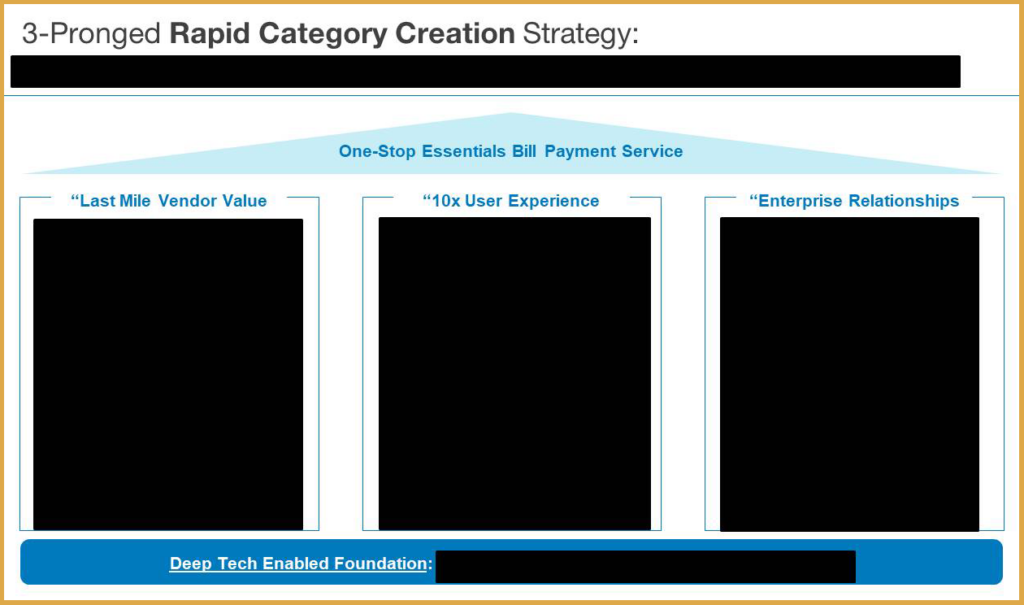

- Slide 3: Business Strategy– “Rule of 3”- What 3 strategies will deliver your vision?

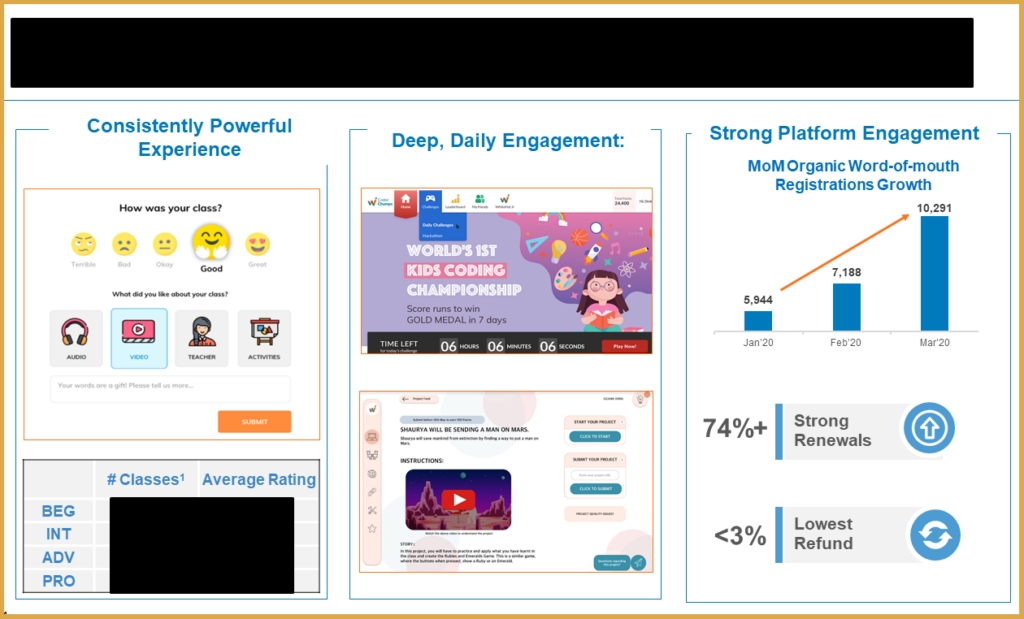

- Slide 4: Consumer Love– NPS, Engagement, Testimonials- Demonstrate how consumers “love” not just like your product?

- Slide 5: Market Size– Simple Visual Calculation of (#Users x ARPU) showing $’s In Billions per Power Law. You don’t need complicated SAM, TAM etc.

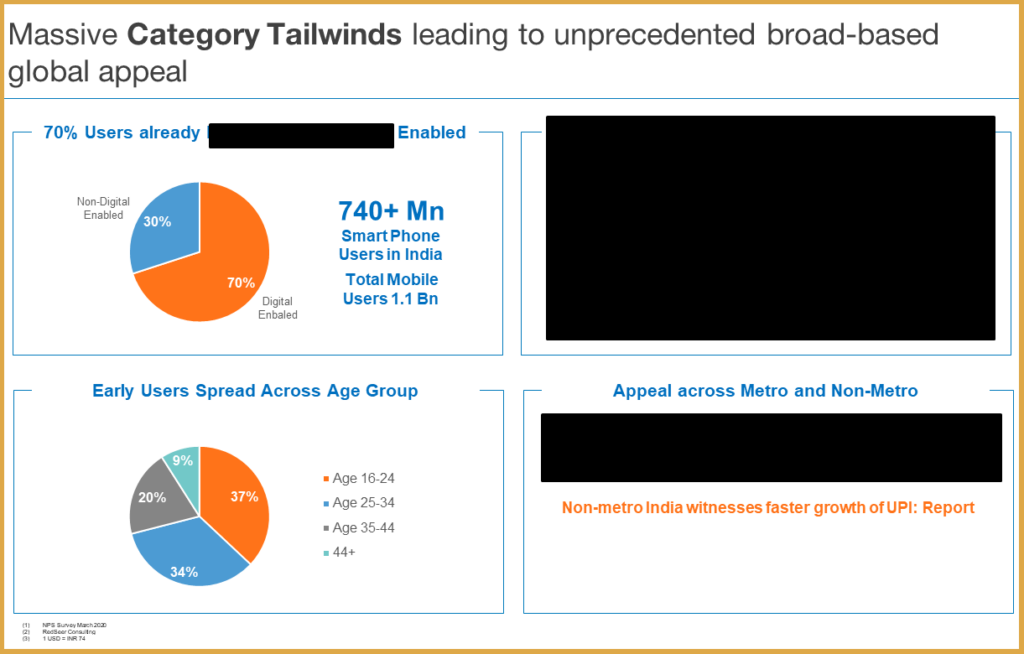

- Slide 6: Category TailWinds- Why Now?- What has changed in the world e.g. Mobile Penetration or Non-Metro adoption to make your idea more relevant than ever?

- Slide 7: Your Tech Disruption in Market- How will your product-tech give 10x user experience?

- Slide 8: Competitive Differentiation– Visually demonstrate why you’re in a (comparatively) Blue Ocean vs Established Players?

- Slide 9: Unit Economics– Demonstrate strong fiscal discipline delivering positive unit economics

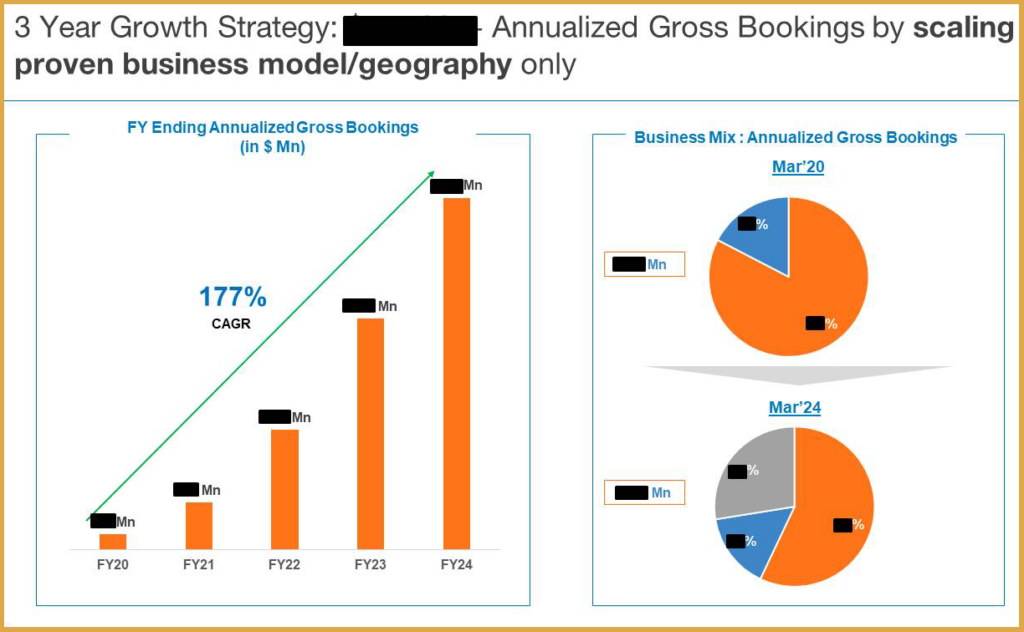

- Slide 10: 3 Year Strategy– Simple Charts to show 3 year growth plan which sets up funding request below

- Slide 11: Application of Funds– Fund-deployment buckets based on strategy above?

- Slide 12: Management Team– Close strong with pictures of a passionate, committed management team.

These 12 slides, done right, will pack enough punch for a Top VC to dive deeper into your model, post which, business model strength + your team conviction will win the day!

Do let me know in the comments if this was useful-nothing would make me happier than to see you create new meaning in the world with your startup. And if you found this useful, you will also like this new YT Video (<10 Minutes) on How to StartUp in 2022 with No Co-Founder.

Please subscribe to the channel here for 3x new videos/week on startup and success models.

¹https://corporatefinanceinstitute.com/resources/knowledge/other/how-vcs-look-at-startups-and-founders/

380 Comments